Digital onboarding is the digital process that allows you to welcome new customers to your company, enabled through a system of identity verification and certification that is both simple and secure.

Digital Onboarding Platform

Discover the platform that simplifies the remote recognition and certification of customer identities, securely and in compliance with the law.

What our customers think of the Digital Onboarding Platform

How digital onboarding works

The digital onboarding platform allows you to perform the following operations:

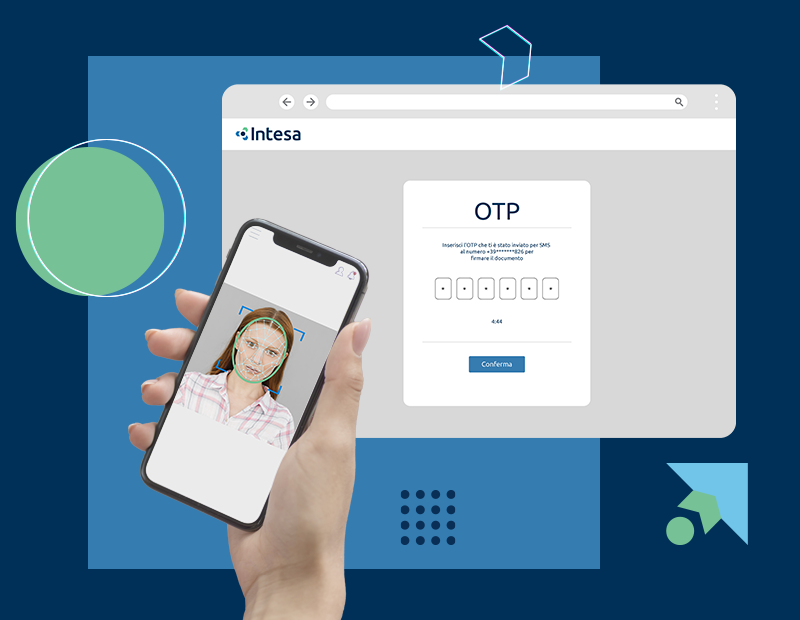

1. Identity verification

Users can be identified securely and reliably.

2. Automation of data collection

Thanks to Optical Character Recognition (OCR) and Artificial Intelligence (AI) features, data can be collected and captured in an automated manner.

3. Biometric match

Biometric verification is conducted to ensure the user’s identity.

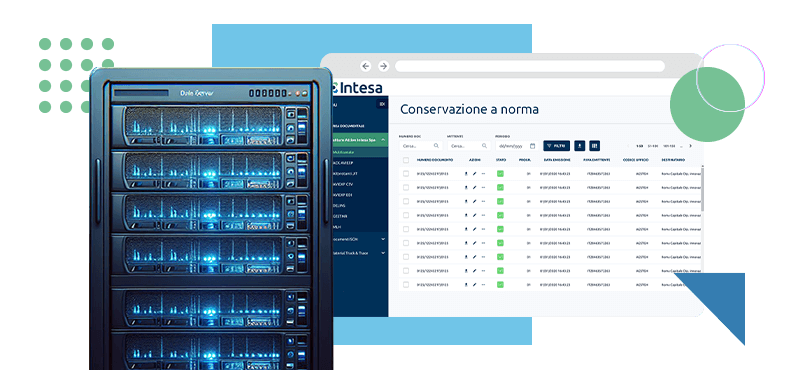

4. Signing and compliant document storage

Documents can be signed and stored in compliance with current regulations.

Benefits of the digital customer onboarding

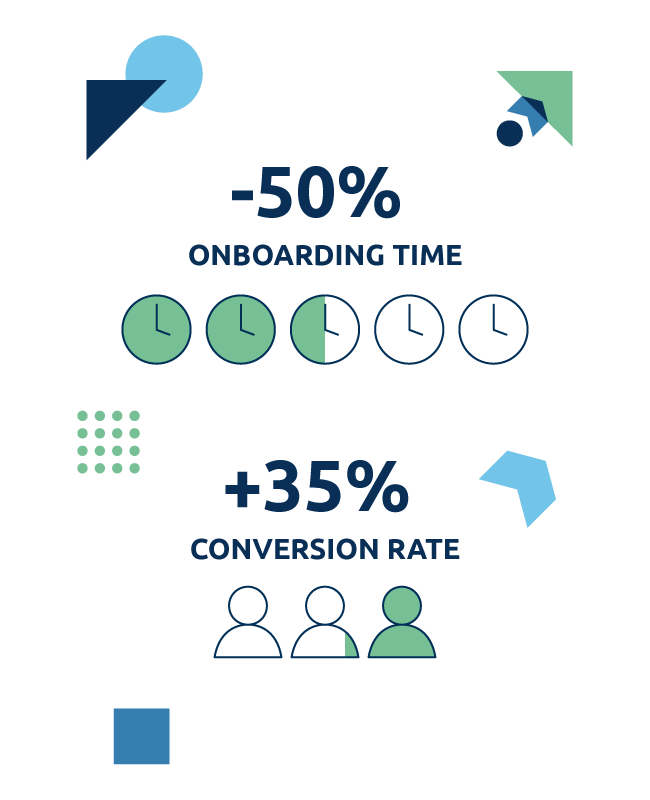

Efficiency

The digital onboarding process reduces registration and identity verification times by 50%, allowing customers to start using services quickly.

Security

Digital identification and verification reduce the risk of fraud and ensure enhanced security in accessing services.

Regulatory Compliance

The digital process makes it easy to comply with document retention regulations and information security standards.

Enhanced User Experience

Streamlined access to services improves the customer experience, encouraging service utilization and increasing the conversion rate by 35%.

Three different customer onboarding methods

1. SPID and CIE

Through Self Onboarding with SPID and CIE, your users can independently verify their identity remotely using their own certified digital identities, such as SPID and CIE. This process allows them to securely and reliably verify and certify their identity through a simple and intuitive experience.

2. Artificial Intelligence (AI)

Utilizing AI, it is possible to authenticate documents and provided information, reducing the risk of fraud even without SPID or CIE. Additionally, AI enables the automation of the identification process, completing customer onboarding without the need for an operator.

3. Video Recognition

Video Recognition involves the customer in a video call where they can validate their identity. During this call, an operator verifies the customer’s identity by comparing their appearance with the provided documents and confirming the consistency of the information.

Request a free consultation

Do you want to understand if this solution suits your needs? Our team of consultants is available to answer all your questions without any obligation.

Transform your business through digital onboarding

Banks and Financial Institutions – Banks and financial services companies use digital onboarding to streamline account opening and the delivery of financial services.

Insurance – Insurance companies leverage this technology to acquire new customers and enter agreements with their distribution network.

Telecom and Internet Services – Telecommunication companies offer simplified online registration procedures through digital onboarding.

Real Estate – Real estate agencies can simplify property rental and sales processes through digital onboarding.

Automotive Sector – Companies selling vehicles online can simplify the purchase and financing processes through digital onboarding.

Leasing – Leasing and long-term rental agents can employ digital onboarding to verify customer identities and ensure secure transactions.

Why choose our digital onboarding solution

A prestigious financial institution has chosen Intesa for the integration of identification through SPID in its onboarding process, aimed at issuing a Qualified Electronic Signature (FEQ). Thanks to this synergy, the phase of accurate identification and the collection of personal data are smoothly completed through a simple SPID access, regardless of the potential customer’s identity provider.

SPID for quick and secure self-onboarding

Intesa has created an identification service for UniCredit where the collection of personal data is entirely concluded through user authentication with SPID.

Frequently Asked Questions about digital onboarding

1. What exactly is digital onboarding?

2. Is digital onboarding suitable for all businesses?

3. Can the Digital Onboarding Platform be integrated into the company's IT systems?

4. Can I generate a legally valid electronic signature with Intesa's Digital Onboarding?

5. What are the advantages of Intesa's Digital Onboarding?

We are at your service

The Intesa team consists of professionals who are reliable and have extensive experience in various market sectors.

Do you have any questions? Would you like to schedule a free and no-obligation consultation call? Fill out the form on the side with your request or simply let us know what you need. We will get back to you as soon as possible.

News and updates about digital onboarding

Regulations

15.07.2024

Digital Trust Services and QTSPs: what they are and why to choose them

Defined by the European eIDAS Regulation, electronic trust services are fundamental to digitalization.

Regulations

15.03.2024

What is the European Digital Identity (EUDI) Wallet and when will it be released?

The European Digital Identity Wallet will allow all EU citizens to access a recognition system valid throughout Europe and will be available in 2026.

Solutions

23.12.2022

CA Autobank: loans go digital

Success Stories: Experiences in the Digital Sphere told by Businesses Themselves.