In the financial sector, the digitalization of services has become a strategic necessity to compete and grow. Intesa positions itself as a key partner in this journey, offering solutions that not only meet current needs but also prepare businesses for future challenges. With our expertise and cutting-edge technologies, we optimize every stage of the process, enhancing operational efficiency and customer experience.

Digital Solutions for Financial Services

Discover digital services for digital banking, insurance, leasing, and consumer credit.

Financial and banking services in the digital era: the ongoing transformation

What our customers think of the Digital Onboarding Platform

The role of remote identification in digital transformation

Remote identification is a key component of digitalization in the financial sector. This service enables financial institutions to verify customer identities without the need for physical presence, using tools such as SPID and CIE. By relying on Intesa, institutions can streamline the onboarding process, reducing verification times and improving service accessibility.

Vantaggi dell’identificazione da remoto

- Operational efficiency: Reduced verification times and a simplified onboarding process.

- Accessibility and convenience: Customers can access financial services anytime, anywhere.

- Security: High standards for personal data protection, ensuring integrity and confidentiality.

Digital contract signing: moving towards a paperless future

Digital signatures are a key element in the transition to a paperless future. This technology allows contracts to be signed in a legally binding way without the need for paper documents, reducing the time and costs associated with physical document management.

Legality and security

Ensures the authenticity and integrity of the signed document.

Simplicity and speed

Sign documents in just a few clicks, from any device, anytime.

Environmental impact

Significantly reduces paper usage and its environmental impact

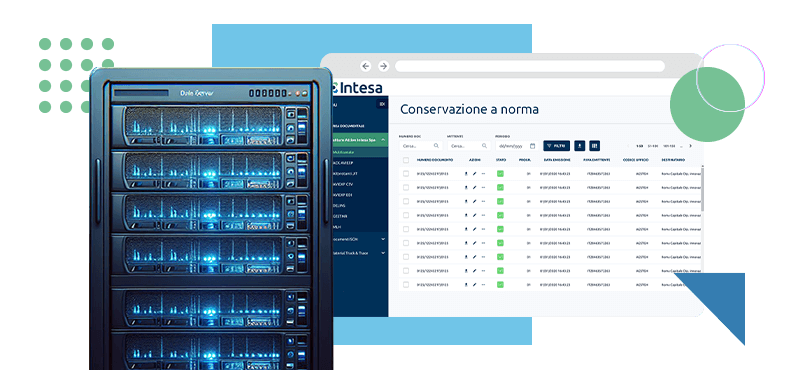

Compliance archiving: security and regulatory compliance in the digital age

Compliance archiving is essential to ensure that digital documents are stored securely and in accordance with current regulations. Intesa offers solutions that protect data and guarantee its integrity over time, ensuring that financial institutions can access documents when needed, in total security.

Benefits of Compliance Archiving

- Regulatory compliance: ensures documents are stored in accordance with Italian and European laws.

- Accessibility and integrity:digital documents remain easily accessible and intact over time.

- Data protection: advanced technologies safeguard digital documents from unauthorized access.

The advantages of digital services for financial services

Customer Experience

Intesa’s solutions integrate seamlessly with our clients’ systems and solutions, including mobile platforms, ensuring a consistent customer experience.

Find the documents

Intesa’s DTM platform ensures the compliant archiving of signed documents and contracts, making them more secure and always accessible.

Sustainability

La sostenibilità è responsabilità di tutti. Con le nostre soluzioni risparmierai emissioni di CO2 e spazio cementificato per gli archivi.

Cost savings

KYC is estimated to cost around €60 million per year. By digitalizing identification and contract signing, you can achieve significant time and cost savings.

Complete digitalization of the customer due diligence

With Intesa, you can fully digitalize Customer Due Diligence, from remote customer identification to the completion of the KYC questionnaire.

Intesa’s Customer Due Diligence platform meets all regulatory and security requirements, ensuring legal validity under eIDAS, providing cost savings for completing procedures, offering direct integration with existing databases, and implementing proactive anti-fraud checks throughout the process.

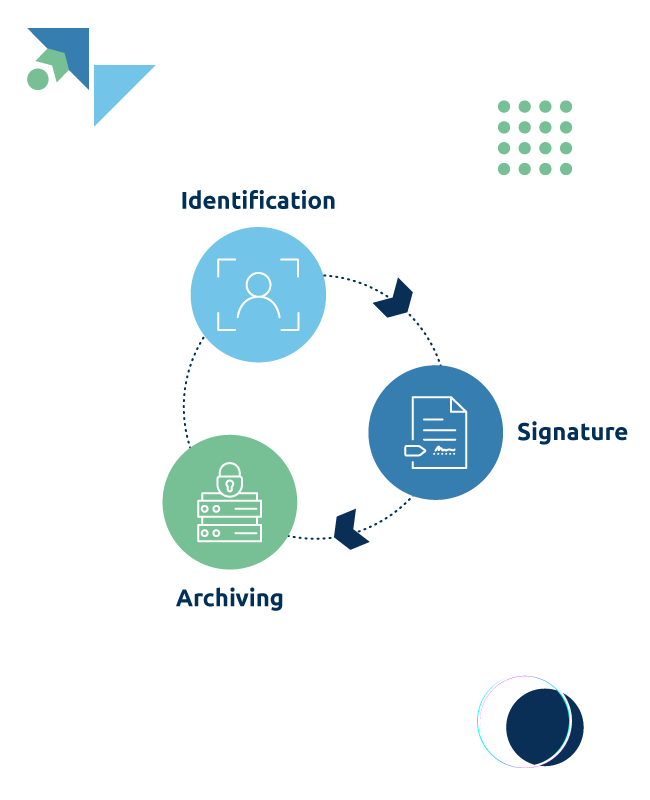

The importance of integrating digital services

The integration of remote identification, digital contract signing, and compliance archiving creates a complete and secure digital workflow. This approach not only improves operational efficiency but also provides a seamless customer experience, meeting the needs of an increasingly digital-oriented market.

1. Synergy between services

The integration of these services ensures a consistent and seamless customer experience.

2. Workflow optimization

Reduction of inefficiencies and improvement of coordination between different departments.

3. Customer satisfaction

By putting the customer at the center of the process, trust and overall satisfaction are enhanced.

We are at your service

The Intesa team consists of professionals who are reliable and have extensive experience in various market sectors. Do you have any questions? Would you like to schedule a free and no-obligation consultation call? Fill out the form on the side with your request or simply let us know what you need. We will get back to you as soon as possible.

Notizie e novità sui Financial Services

Solutions

03.02.2022

BPER: Retooling company processes to ensure a 360-degree customer experience

Success Stories as told by our customers

Who chose us

Intesa è stata scelta da numerose aziende leader nel settore per le loro esigenze di conservazione digitale. Unisciti a loro e godi di una soluzione di archiviazione all’avanguardia.