Electronic invoicing for companies

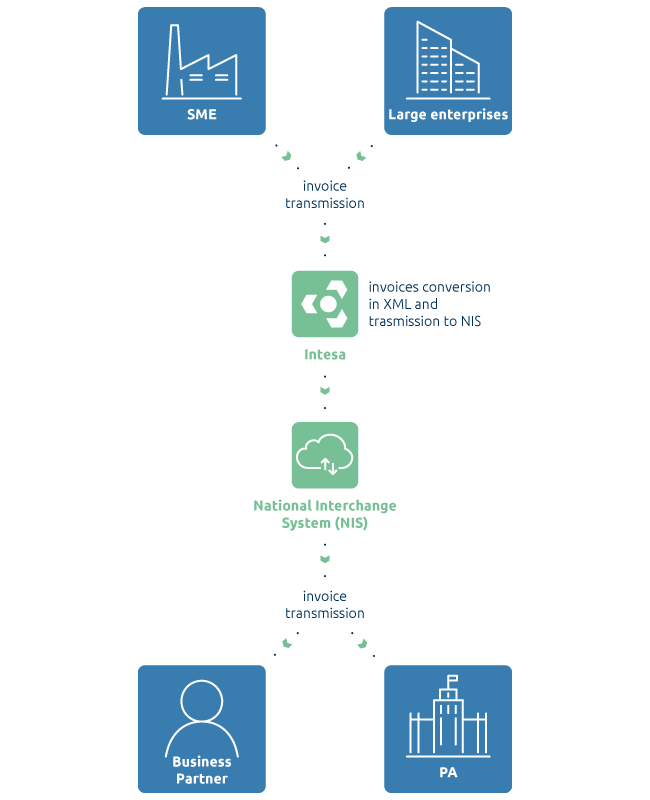

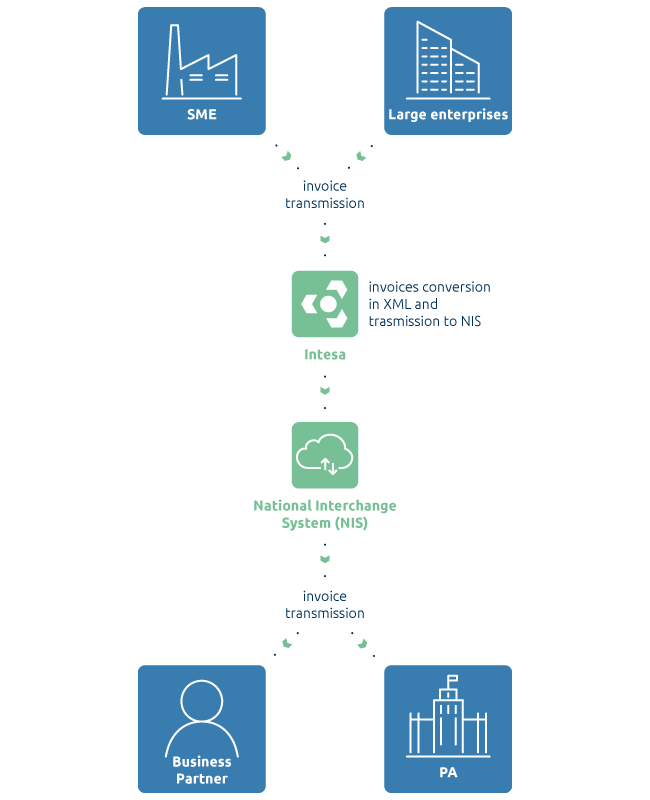

Our platform handles the electronic invoicing exchange process for both SMEs and large enterprises. We have been dealing with electronic invoicing since the beginning.

Manage electronic invoicing exchange with all your partners

Intesa provides a comprehensive and secure electronic invoicing solution for Italian businesses, offering a range of features to help you issue, receive, sign, archive, and store your electronic invoices securely and in compliance with current regulations.

The solution is suitable for both private sector invoicing and invoicing with Public Administrations. Intesa ensures connectivity with any partner or institution, can handle large invoice volumes, and seamlessly integrates with major ERPs and existing business software with minimal impact.

What our customers think about the invoicing solution

The benefits of our electronic invoicing

No Formal Errors in Transmission

Electronic invoicing significantly reduces the risk of formal errors during document transmission.

Fast Integration with Systems

Implementing electronic invoicing allows for quick and seamless integration with existing business systems.

Minimal Impact on Business Management

The transition to electronic invoicing is designed to have a minimal impact on business management systems.

Compliant Archiving Included

Electronic invoicing often includes integrated solutions for compliant digital archiving, ensuring that electronic documents are stored in accordance with legal regulations.

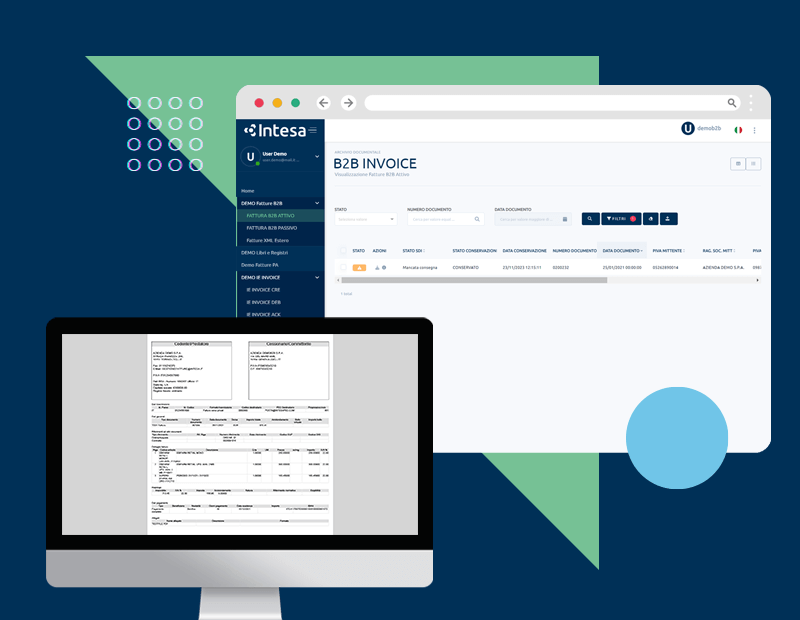

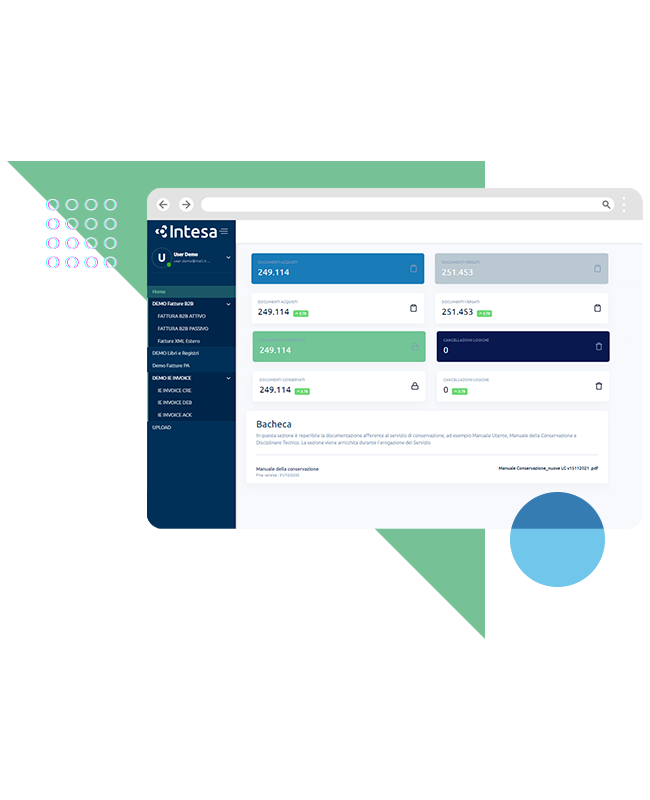

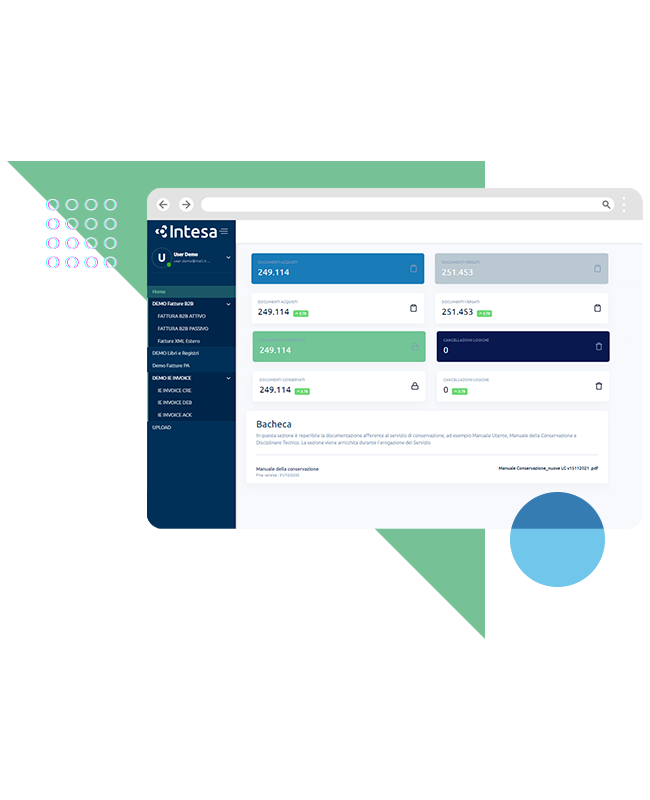

Discover Intesa Hive, the platform that lets you monitor all your business documents from a single interface—whether they come from EDI services, long-term compliant archiving, or e-invoicing.

The complete and integrated solution for managing the entire electronic invoicing exchange process

In addition to fulfilling regulatory obligations, our service allows you to manage and standardize the information within issued and received documents, “translating” them into the correct format and automating communications with the Interchange System.

1. Receipt and Standardization

The solution receives electronic invoices in formats supported by customer software and management systems, standardizing data for transmission to the Interchange System based on regulatory requirements. Before sending, if necessary, the system digitally signs all invoices to be sent and verifies the formal correctness of the data required for transmission, eliminating transmission errors.

2. Acquisition and Transmission

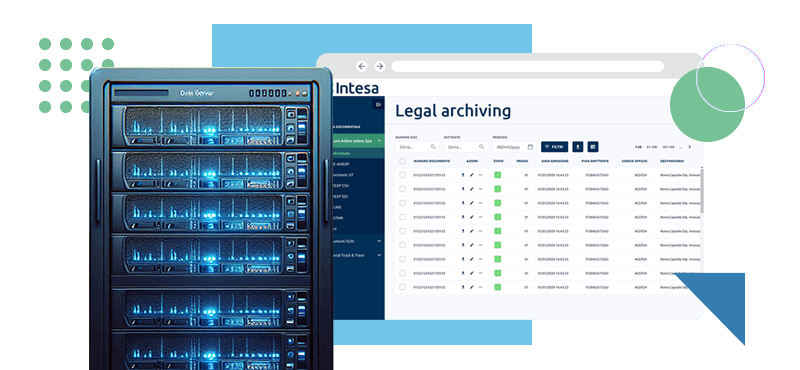

3. Archiving and Conservation

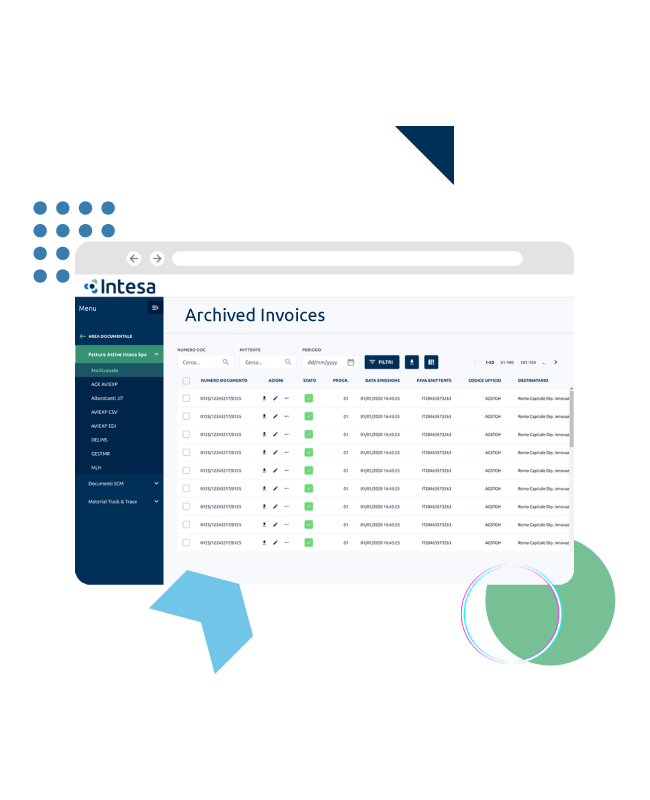

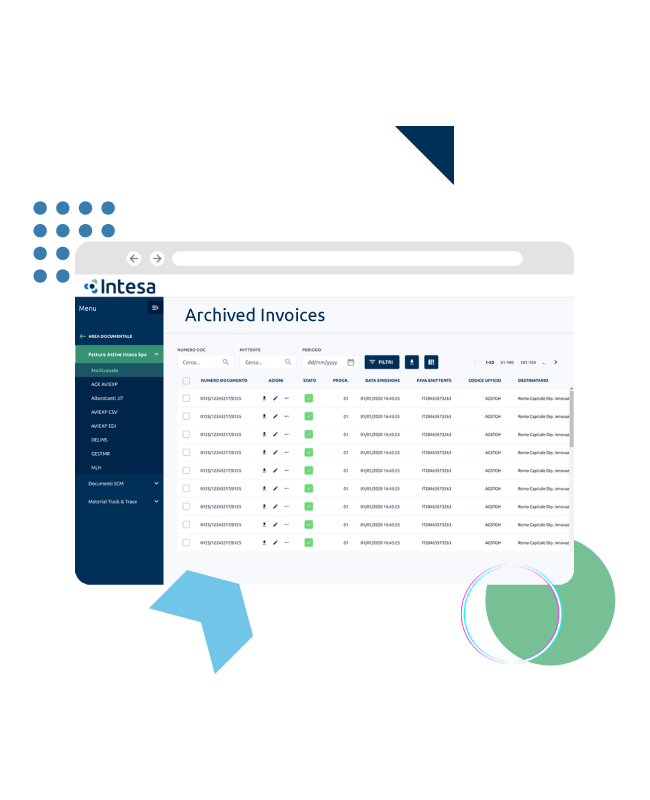

The solution includes compliant digital archiving of invoices. Invoices are automatically archived from the reception phase by customer systems. You can easily view invoices and related notifications through a system of views and search keys that can be customized based on customer needs.

4. Acquisition of Passive Invoices in XML Format

Acquire passive invoices received via enabled connector in electronic format. If necessary, the service converts received invoices into the accepted and most suitable format for customer software and management systems. Additionally, through the portal, it is always possible to view received invoices.

Request a free consultation

Do you want to understand if this solution suits your needs? Our team of consultants is available to answer all your questions without any obligation.

Why choose Intesa’s electronic invoicing?

We have been working in the digitization of order cycle documents for over 35 years and stay updated on regulatory developments in Italy and abroad. Our solution is adaptable to the needs of large enterprises for processing large volumes of invoices and seamlessly integrates with existing business systems. We don’t sell a one-size-fits-all solution; we will always tailor it to the needs of your market.

Three different modes of electronic invoicing

1. Public Administration (PA) and B2B Invoicing

Intesa offers an electronic invoicing service dedicated to Public Administration and B2B businesses, enabling the sending and receiving of electronic invoices. The platform adapts to the needs of small, medium, and large enterprises, integrating with existing management systems. The solution provides easy management and comprehensive monitoring of the entire document cycle, from issuance in XML format to compliant archiving to ensure probative value.

2. International and European Electronic Invoicing

Other European countries are gradually moving towards the obligation of B2B electronic invoicing: France, Belgium, Poland, and Latvia, for example, have already confirmed this. However, it is highly likely that each country will adopt different standards and methods. Through a partnership with Pagero, a smart business network globally, our company ensures through its management platforms adequate interoperability of electronic invoicing at the European and international levels. We commit to receiving electronic invoices from its customers, transferring them to Pagero, which will convert the digital documents into the most suitable format for the digital infrastructure of each country.

3. Nodo Smistamento Ordini

Through the Nodo Smistamento Ordini, suppliers of the National Health System can receive orders and send responses in digital format (UBL) directly and easily. The system provides a solution that best meets customer demands without impacting their supply chain. Through this service, the entire process can be managed: document preparation – generation of the layout and data verification – sending to the Order Routing Node, management, and archiving. Through a convenient and dedicated dashboard, the customer can monitor all events and notifications in a simple and clear manner.

Frequently asked questions on the electronic invoicing

1. Differences between Structured and Unstructured Electronic Invoicing

The main difference between structured and unstructured electronic invoicing lies in the modes and formats of transmission. Unstructured invoices are typically in PDF, Word, PNG, or JPG format and are usually exchanged via email. However, invoices exchanged in this way cannot be considered electronic invoices. Electronic invoices must have a structured format, meaning a format that is automatically readable by business systems and the Interchange System.

2. Can I Issue Electronic Invoices to a Foreign Customer?

To send an electronic invoice to a foreign customer, it is necessary to first issue a regular electronic invoice, indicating the correct code in the “customer code” field and routing it through the Interchange System. However, the customer may have specific requirements for the electronic invoice format based on their country’s laws or business systems. In such cases, it may be useful to rely on experienced service providers in the specific field.

3. What Is PEPPOL Access Point to Facilitate Electronic Invoicing?

A PEPPOL Access Point is a service provider that allows connecting to the PEPPOL network and sending invoices through this channel. PEPPOL is an acronym for the IT infrastructure enabling B2B and PA companies to exchange invoices across Europe.

4. Can Electronic Invoices Be Sent via EDI?

Absolutely, electronic invoices can be exchanged via EDI, along with all other documents in the order cycle (sending orders, receiving confirmations, and optionally transport documents). If you want to exchange invoices via EDI, the only consideration is to ensure that the invoices sent to the Interchange System are accepted and error-free.

5. Is It Mandatory to Archive Invoices in Electronic Format?

Yes, it is mandatory to archive invoices in electronic format. Invoices are valid fiscal documents and must be retained for at least 10 years, as specified in Article 2220 of the Civil Code.

We are at your service

The Intesa team consists of professionals who are reliable and have extensive experience in various market sectors. Do you have any questions? Would you like to schedule a free and no-obligation consultation call? Fill out the form on the side with your request or simply let us know what you need. We will get back to you as soon as possible.

You might also be interested in these services

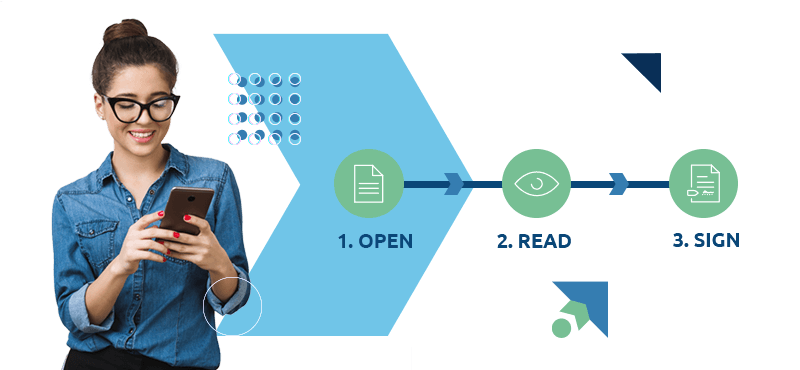

ELECTRONIC SIGNATURE

ELECTRONIC SIGNATURE

Flexibility first

Discover the solution that allows you to apply your Electronic Signature to digital documents quickly, intuitively, and extremely securely. The documents will have the same legal validity as a traditional handwritten signature.

EDI

EDI

Exchange information automatically

Intesa’s Electronic Data Interchange (EDI) application automates supply chain processes and enhances business relationships with partners distributed worldwide.

ELECTRONIC ARCHIVING

ELECTRONIC ARCHIVING

Your documents safe and accessible

A comprehensive and secure service for digital document storage, ensuring compliance with regulations, protection of sensitive data, and certification of document authenticity and integrity.