Mandatory electronic invoicing in Germany from 2025

How to Comply with the Mandatory Electronic Invoicing Requirement in Germany

Starting from January 1, 2025, electronic invoicing will become mandatory in Germany for all B2B and B2G transactions, marking a significant step towards business digitalization. Companies with offices in Germany will need to comply with the new requirements for the transmission and storage of electronic invoices, ensuring compliance and a more efficient management of accounting processes.

Discover with us:

This requirement will come into effect on January 1, 2025, following the approval of the Wachstumschancengesetz, the German law promoting growth, investment, innovation, and greater tax fairness, aligning with the European Union’s ViDA directive initiatives.

What do companies with offices in Germany need to do to comply? How should they manage the exchange of “domestic” electronic invoices with German partners starting in January? Here is a detailed step-by-step guide.

Introduction: The Mandatory Electronic Invoicing Requirement in Germany

Starting from January 1, 2025, Germany will begin the process of making electronic invoicing mandatory for all companies in B2G and B2B transactions, both for incoming and outgoing invoices. This new regulation marks a crucial step toward the digitalization of business processes and the reduction of tax evasion.

German companies and large Italian groups with offices in Germany will need to promptly adapt to the new requirements for issuing, receiving, and storing electronic invoices, in compliance with European standards and the most common German formats.

The Timeline of the Mandatory Electronic Invoicing Requirement

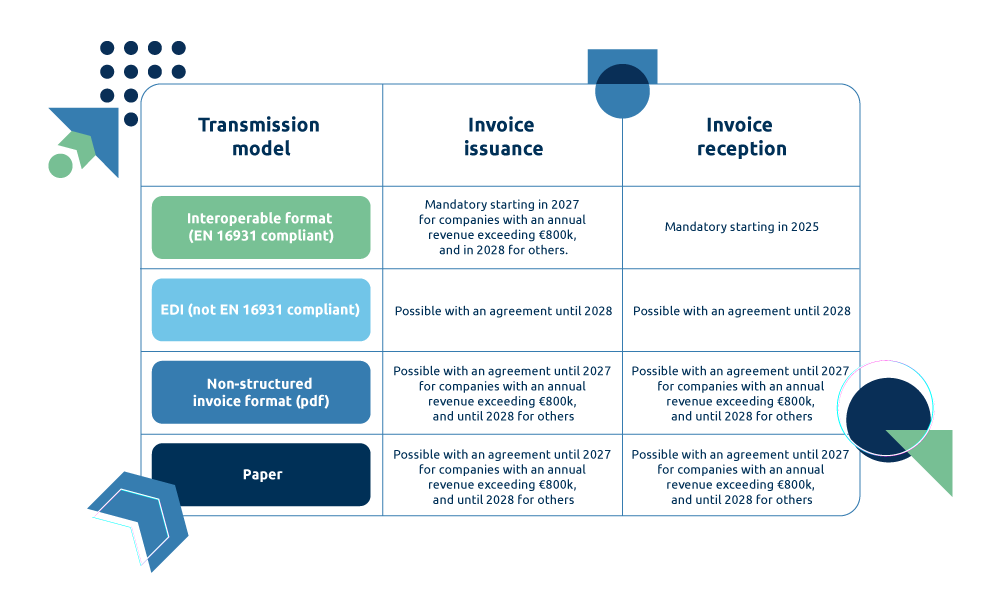

The introduction of electronic invoicing in Germany will occur in three defined steps:

- From January 1, 2025: Structured electronic invoices become the default in Germany. All companies will be required to accept B2B electronic invoices in structured formats compliant with EN 16931 standards.

Suppliers, however, will still be able to send invoices in non-electronic formats (even paper invoices are allowed). However, in this case, and for invoices in non-structured formats (such as PDFs) or EDI invoices not compliant with EN standards, the buyer’s consent will be required.

- From January 1, 2027: The electronic invoicing obligation will be extended to companies with a turnover of over 800,000 euros, which will no longer be able to issue paper invoices or structured electronic invoices, even with the buyer’s consent.

- From January 1, 2028: All B2B transactions, regardless of the company size, will have to be conducted with structured electronic invoicing for both outgoing and incoming invoices.

Electronic Invoice Format

According to the provisions of the Bundesministerium der Finanzen, electronic invoices exchanged with German companies must follow the European standard for electronic invoicing and the list of related syntaxes under Directive 2014/55/EU of the European Parliament, or be in a format agreed upon between the seller and the buyer, provided that the correct and complete extraction of the required information is possible in a format that complies with EN 16931 or is interoperable with it.

- Standards Used: For this purpose, Germany will always accept the XRechnung and ZUGFeRD formats (updated versions), which allow for the structured electronic transmission in compliance with European standards.

- Specific Requirements: In order for an electronic invoice to be considered valid, regardless of its format, it must contain the mandatory data for VAT purposes, such as the invoice number, complete details of the supplier and the customer, and the amount. Regarding the description of the service, it must also be included in the structured part of the electronic invoice and allow for clear and verifiable identification of the service provided.

- Hybrid Invoices: Hybrid invoices are also accepted (e.g., ZUGFeRD), which include part of the information in a structured format (such as XML) and part in an unstructured but human-readable format (e.g., a PDF document). However, both formats must be combined into a single file.

Transmission of Electronic Invoices in Germany

The new German regulation does not impose a specific transmission method, nor does it introduce a centralized exchange system like SdI. The transmission of electronic invoices in Germany can therefore occur in various ways, as specified in point 36 of the Ministry of Finance’s document. “For the transmission of electronic invoices, methods such as sending via email, providing data through an electronic interface, shared access to a central archive within a corporate group, or the possibility of downloading via an internet portal can be considered.” Therefore, it will be possible to use:

- PEPPOL: For the transmission and exchange of electronic invoices with Germany, the PEPPOL network can always be used.

- Tax Authority: The transmission of electronic invoices will occur through secure channels that allow direct monitoring of transactions by the tax authorities, for example, through local public administration portals.

- Email: The transmission of electronic invoices via email to German partners is always possible, even without a dedicated inbox. However, this is not recommended for recipients, given the difficulty of reading structured formats sent via email and the high likelihood of losing the documents.

What’s PEPPOL?

PEPPOL (Pan-European Public Procurement Online) is a network that standardizes and facilitates the electronic exchange of business documents between public and private entities, not only at the European level but also internationally. Its main purpose is to simplify and improve the efficiency of procurement and electronic invoicing processes between businesses and governments.

PEPPOL provides a common standard for the electronic transmission of business documents such as orders, invoices, and credit notes, regardless of the platform or software used by the parties involved.

Why Rely on a Provider like Intesa?

To support companies in digitizing their invoicing process and complying with this important regulatory requirement, Intesa has already developed a dedicated service for Italian companies and large groups with offices in Germany and a German VAT number, enabling them to adapt their foreign offices to send and receive electronic invoices in compliance with local regulations.

Additionally, Intesa’s solution is designed to accommodate future electronic invoicing obligations in other European countries, as well as provide compliant document archiving for German records. In fact, Intesa already manages the archiving of fiscal documents in Germany.

By relying on Intesa, companies will not only be able to easily comply with Germany’s new regulations, but they will also be prepared for the inevitable introduction of similar requirements in other European countries, such as Belgium (from January 1, 2026), Poland (from February 1, 2026), France (from September 1, 2026), and Spain (expected in 2026/2027). With a single centralized connection point (Intesa), they will be able to streamline the process. This represents a significant advantage for international corporate groups, who will benefit from a comprehensive service and a simple, scalable approach to future European obligations.

Here are the details of Intesa’s electronic invoicing service for Germany.

Incoming Process (mandatory from January 1, 2025):

- Creation of the communication channel (registration on the Peppol network with the recipient’s customer ID).

- Receipt of the incoming invoice through the channel (must be EN compliant – supported formats: ZUGFeRD, XRechnung, and Peppol BIS).

- Viewing the original archived invoice and its readable PDF version on the Intesa portal.

Outgoing Process (currently optional, mandatory in phases from 2027):

- Creation of the invoice in the format agreed upon with Intesa (B2B XML from Italy, accompanied by the enrichment CSV).

- Conversion into the format required by German regulations (EN compliant – supported formats: ZUGFeRD, XRechnung, and Peppol BIS) and transmission via the PEPPOL communication channel to the designated recipient.

- Viewing the final archived invoice on the Intesa portal, along with any statuses and notifications required.