Digital Onboarding Platform

Discover the platform that simplifies the remote recognition and certification of customer identities, securely and in compliance with the law.

What is digital onboarding?

Digital onboarding is the digital process that allows you to welcome new customers to your company, enabled through a system of identity verification and certification that is both simple and secure.

With our Digital Onboarding Platform, customers can be quickly identified online from a remote location, and they can view and electronically sign digital documents. The benefits for businesses are numerous, including the elimination of the use of paper documents, the ability to use qualified electronic signature certificates with legal value, integrated and traceable data management, as well as regulatory compliance in document retention.

Biometric recognition systems and Artificial Intelligence (AI) play a crucial role in ensuring maximum reliability, streamlining the process, and reducing errors.

What our customers think of the Digital Onboarding Platform

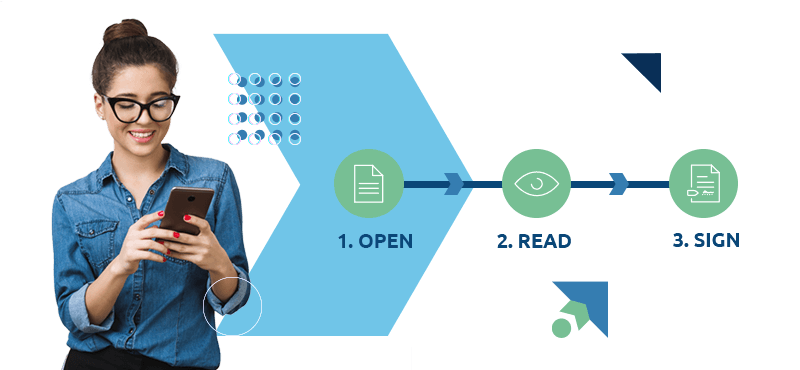

How digital onboarding works

The digital onboarding platform allows you to perform the following operations:

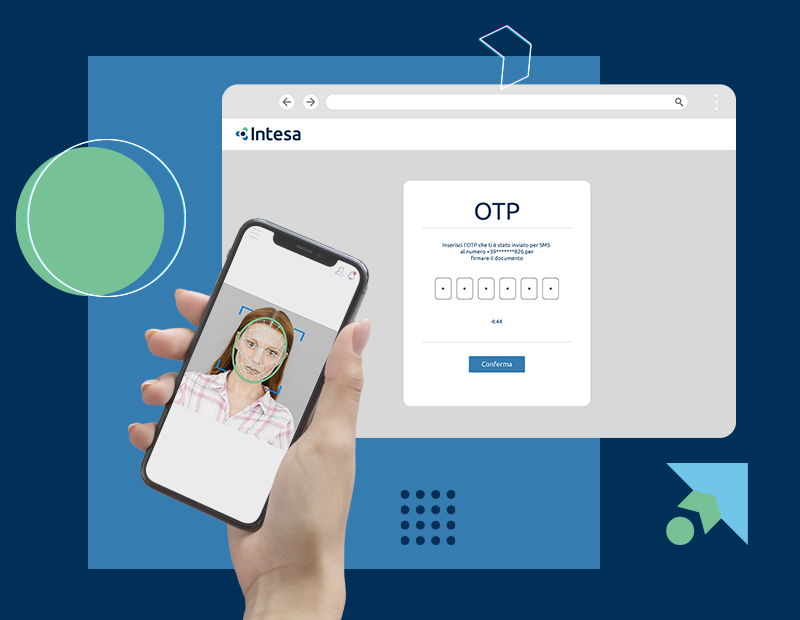

1. Identity verification

Users can be identified securely and reliably.

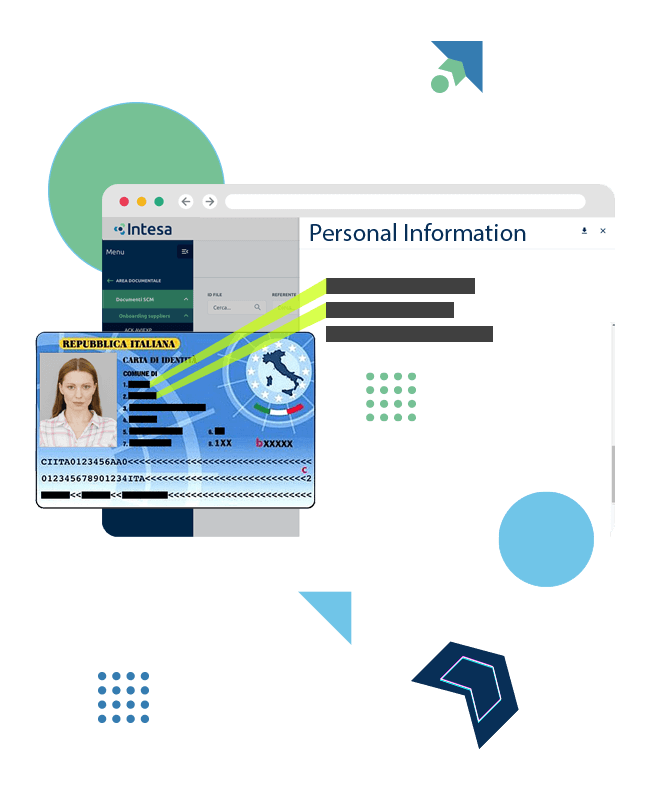

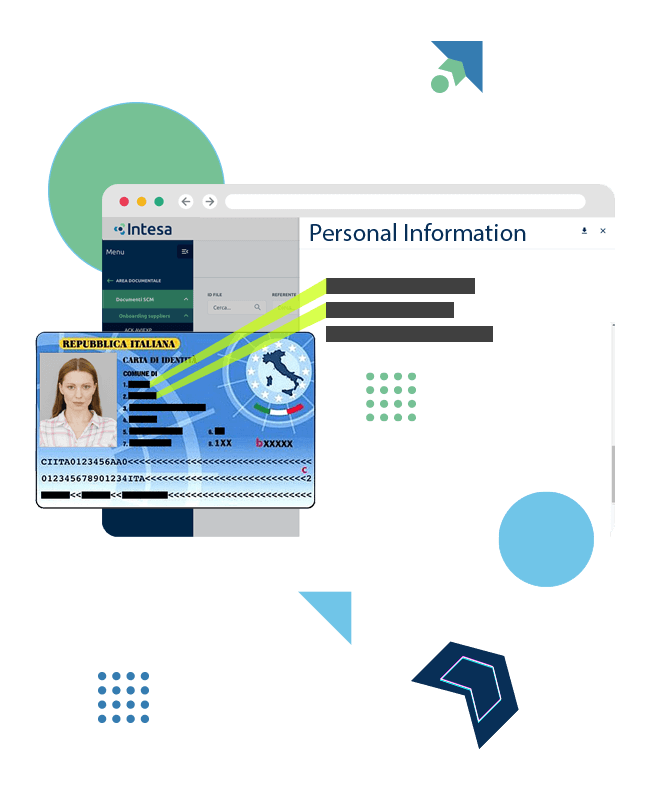

2. Automation of data collection

3. Biometric match

Biometric verification is conducted to ensure the user’s identity.

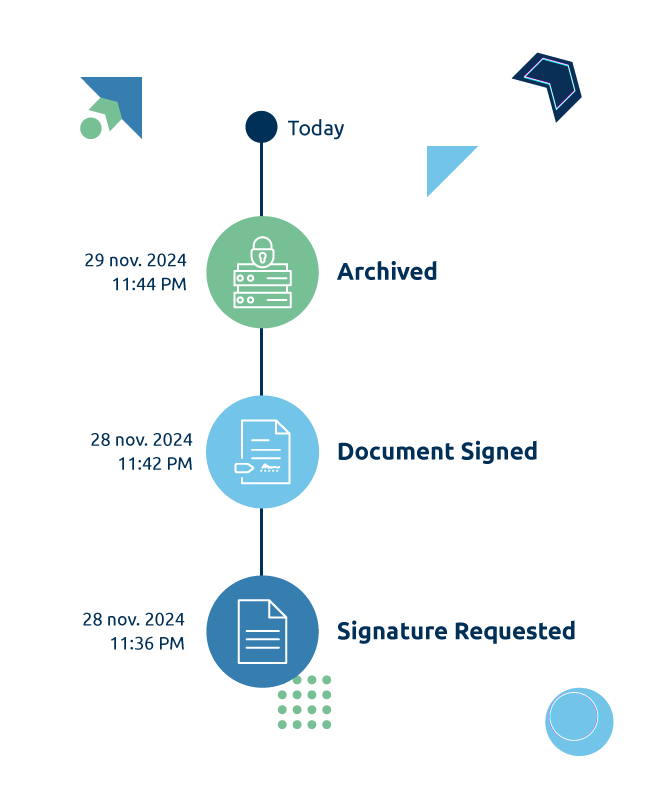

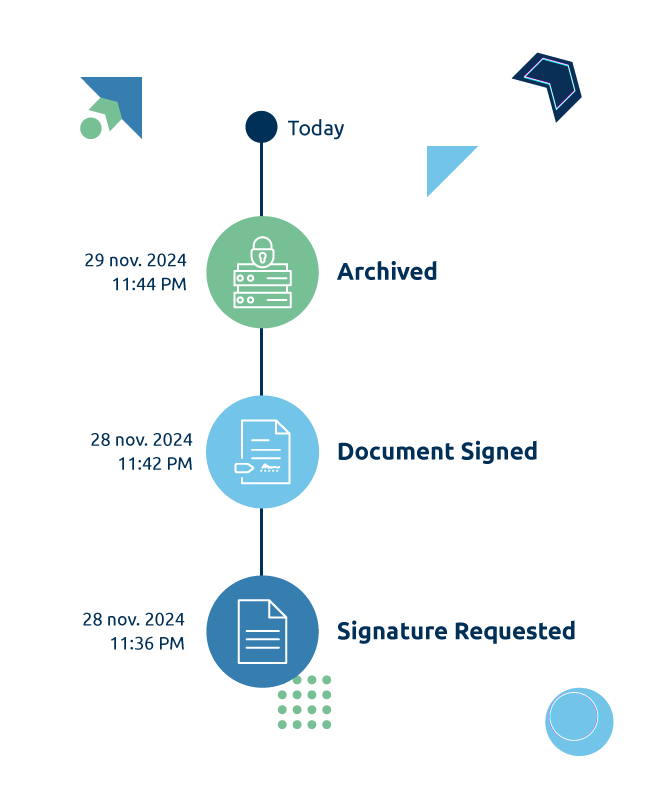

4. Signing and compliant document storage

Documents can be signed and stored in compliance with current regulations.

Benefits of the digital customer onboarding

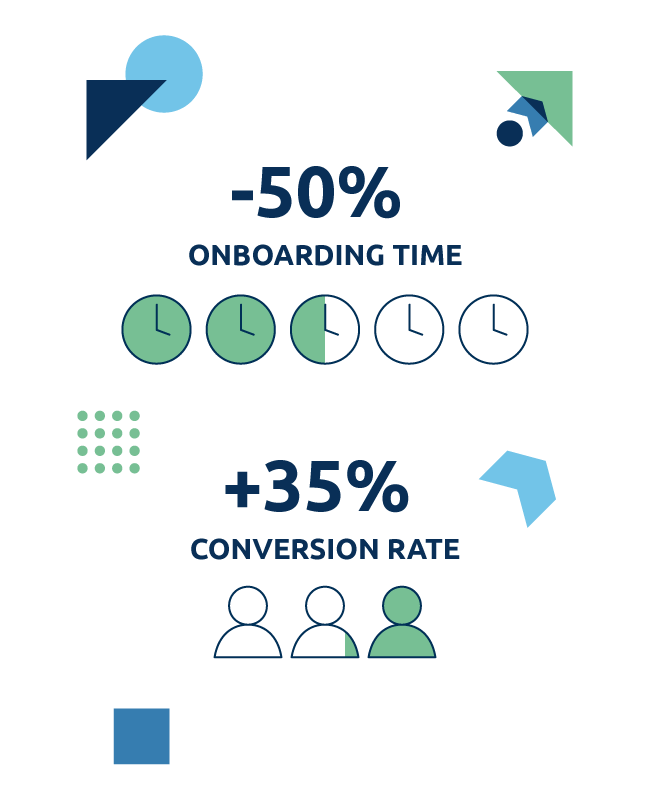

Efficiency

The digital onboarding process reduces registration and identity verification times by 50%, allowing customers to start using services quickly.

Security

Digital identification and verification reduce the risk of fraud and ensure enhanced security in accessing services.

Regulatory Compliance

The digital process makes it easy to comply with document retention regulations and information security standards.

Enhanced User Experience

Streamlined access to services improves the customer experience, encouraging service utilization and increasing the conversion rate by 35%.

Three different customer onboarding methods

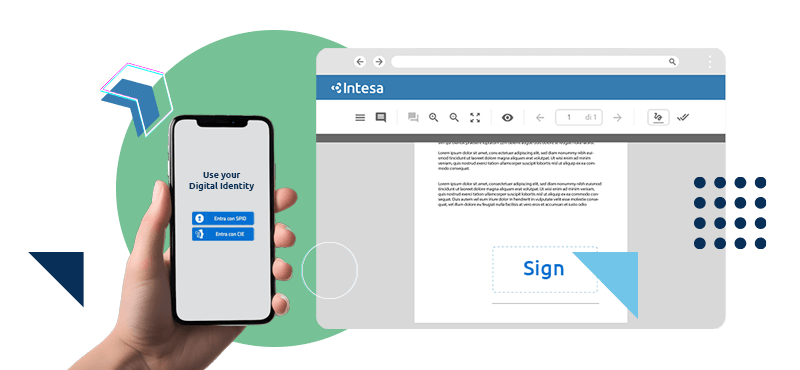

1. SPID and CIE

Through Self Onboarding with SPID and CIE, your users can independently verify their identity remotely using their own certified digital identities, such as SPID and CIE. This process allows them to securely and reliably verify and certify their identity through a simple and intuitive experience.

2. Artificial Intelligence (AI)

Utilizing AI, it is possible to authenticate documents and provided information, reducing the risk of fraud even without SPID or CIE. Additionally, AI enables the automation of the identification process, completing customer onboarding without the need for an operator.

3. Video Recognition

Video Recognition involves the customer in a video call where they can validate their identity. During this call, an operator verifies the customer’s identity by comparing their appearance with the provided documents and confirming the consistency of the information.

Request a free consultation

Do you want to understand if this solution suits your needs? Our team of consultants is available to answer all your questions without any obligation.

Transform your business through digital onboarding

Banks and Financial Institutions – Banks and financial services companies use digital onboarding to streamline account opening and the delivery of financial services.

Insurance – Insurance companies leverage this technology to acquire new customers and enter agreements with their distribution network.

Telecom and Internet Services – Telecommunication companies offer simplified online registration procedures through digital onboarding.

Real Estate – Real estate agencies can simplify property rental and sales processes through digital onboarding.

Automotive Sector – Companies selling vehicles online can simplify the purchase and financing processes through digital onboarding.

Leasing – Leasing and long-term rental agents can employ digital onboarding to verify customer identities and ensure secure transactions.

Why choose our digital onboarding solution

A prestigious financial institution has chosen Intesa for the integration of identification through SPID in its onboarding process, aimed at issuing a Qualified Electronic Signature (FEQ). Thanks to this synergy, the phase of accurate identification and the collection of personal data are smoothly completed through a simple SPID access, regardless of the potential customer’s identity provider.

This implemented solution has significantly optimized the identification process, thus expediting the issuance of the electronic signature.

Frequently Asked Questions about digital onboarding

1. What exactly is digital onboarding?

The term “digital onboarding” refers to the online procedure for remotely identifying customers. It is used to collect personal data, documents, and verify that those seeking access to digital services are real individuals with valid documents.

2. Is digital onboarding suitable for all businesses?

Certainly! Digital onboarding can be used for both B2C customer identification and HR resource onboarding. It can be applied to any type of business.

3. Can the Digital Onboarding Platform be integrated into the company's IT systems?

Intesa’s digital onboarding platform is usable on both mobile and browser, and it can be easily integrated via API with existing company processes and the reference CRM.

4. Can I generate a legally valid electronic signature with Intesa's Digital Onboarding?

For the issuance and application of legally valid qualified electronic signatures, Intesa provides the Intesa Sign platform, where user recognition can be done through AI, SPID, or CIE for the issuance of signature certificates.

5. What are the advantages of Intesa's Digital Onboarding?

Digital onboarding reduces the time for acquiring and recognizing a customer from a week to a few hours. It also ensures consistently correct data and documents without the need for manual checks, and all documentation is already in digital format, ready for storage within the CRM.

We are at your service

The Intesa team consists of professionals who are reliable and have extensive experience in various market sectors. Do you have any questions? Would you like to schedule a free and no-obligation consultation call? Fill out the form on the side with your request or simply let us know what you need. We will get back to you as soon as possible.

You might also be interested in these services

ELECTRONIC SIGNATURE

ELECTRONIC SIGNATURE

Flexibility first

Discover the solution that allows you to apply your Electronic Signature to digital documents quickly, intuitively, and extremely securely. The documents will have the same legal validity as a traditional handwritten signature.

INTESA SIGN

INTESA SIGN

Secure and simple signing

Our web and mobile application for electronic signatures is easy, flexible, and intuitive. It also integrates recognition with SPID and CIE for FEQ signing.

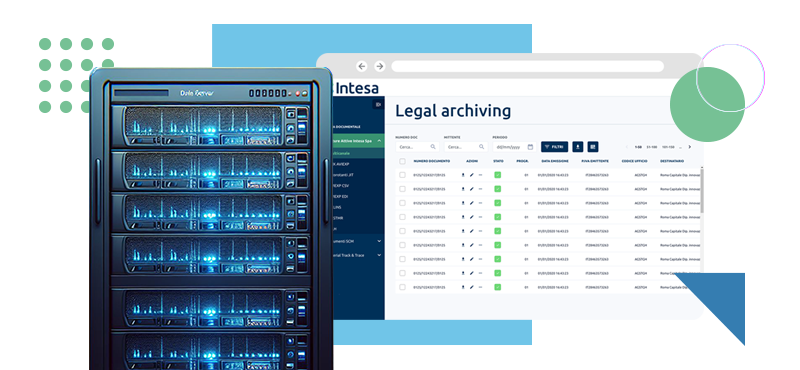

ELECTRONIC ARCHIVING

ELECTRONIC ARCHIVING

Your documents safe and accessible

A comprehensive and secure service for digital document storage, ensuring compliance with regulations, protection of sensitive data, and certification of document authenticity and integrity.